Why NSW for cobalt

• Third largest Economic Demonstrated Resource (EDR) in Australia for cobalt resources

• Hosts over 489,000 tonnes of cobalt

• Opportunities for cobalt investment, which is a critical specialty metal with high supply risk

Overview

In 2023, about 29% (61.8 kt) of cobalt demand was for electric vehicle batteries, which is expected to increase to 58% (236 kt) of cobalt demand by 2030 (Source: IEA). Many rechargeable batteries use cobalt because it increases battery energy density, lifespan and charging speed. Despite lower prices in 2023 for cobalt (and lithium), demand for electric vehicles and other battery-using technology is expected to increase cobalt prices in the medium term.

There are a range of uses for cobalt including magnetic, wear-resistant, high strength, high temperature superalloys. It is used in jet engines and other gas turbines, in permanent magnets, steam turbines, in surgical implants and in high-speed tool steel. Cobalt metal is a catalyst for producing plastics, liquid fuels and certain adhesives amongst other applications.

Pure cobalt rarely occurs naturally on Earth. It is found in copper and nickel ores. Complex processing is required to extract and concentrate cobalt.

Cobalt is traded as cobalt metal and cobalt chemicals — often cobalt sulfate and cobalt hydroxide — and to refineries as concentrates, hydroxide and metal hydroxide precipitate. It is traded between companies, because volumes are low.

Most cobalt is produced in the Democratic Republic of Congo from mines with limited environmental, social and corporate governance standards, and sent to China where it is processed.

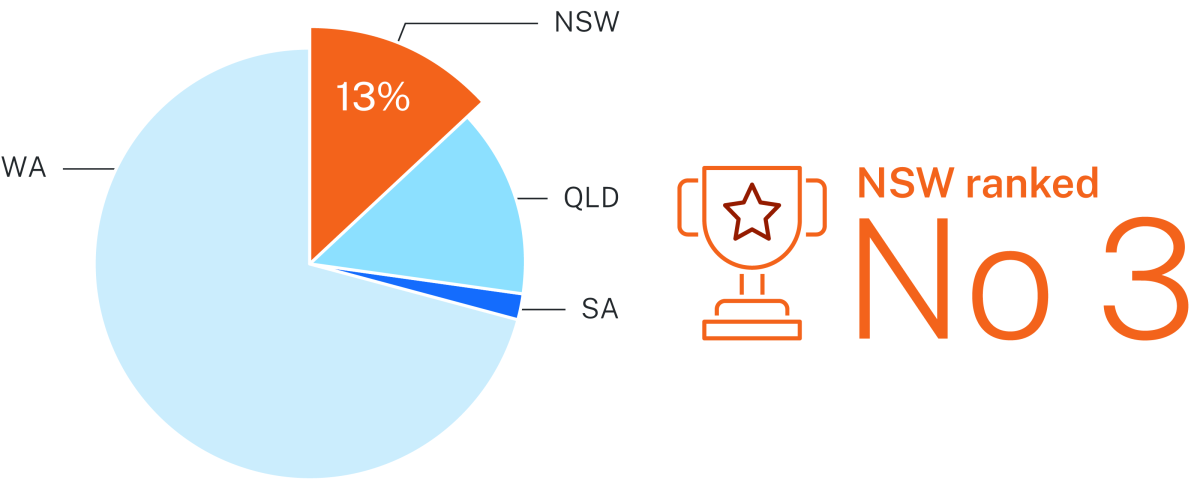

NSW resource

NSW is ranked third in Australia for cobalt resources, holding 13% of Australia’s Economic Demonstrated Resource (Source: Geoscience Australia, Australia's Identified Mineral Resources 2023).

NSW occurrences of cobalt include nickel-cobalt laterites and cobalt pyrite in the Lachlan Orogen and Far West region of the state. Albite-pyrite rocks near Broken Hill host the Pyrite Hill and Railway deposits (Cobalt Blue’s Broken Hill Cobalt Project). Their simple mineralogy makes these deposits amenable to cobalt recovery.

Nickel-cobalt laterite-hosted deposits are developed over ultramafic rocks, including the Fifield Igneous Complex, which hosts many of the major deposits including Sunrise, Burra and Flemington and the Great Serpentinite Belt (e.g. Adanaree and Thuddungra).

Cobalt has also been produced as a by-product of smelting base-metal ore at Broken Hill, from near Bungonia. It has also been produced from laterites near Carcoar and Port Macquarie.

Cobalt in NSW map

Download the Cobalt in NSW map (PDF, 3.1 MB).

Essential uses

Rechargeable batteries |

Electric vehicles |

Magnets |

| Superalloys | ||

Solar PV |

Wind turbines |

Aircraft |

Quality data for explorers

NSW is known for its world class pre-competitive data, and has a long history of providing geological, geoscientific and geochemical data to promote investment in exploration.

Pre-competitive data to support cobalt exploration (and other commodities) is made freely available on the Geological Survey of NSW’s web map application MinView.

The NSW Government recently completed its largest ever geophysical survey acquisition program through airborne electromagnetic, airborne magnetic and radiometric, gravity, and deep crustal reflection seismic surveys. These surveys collected over 150,000 km2 of new data across the New England Orogen, the Lachlan Orogen and the Murray Basin areas that are prospective for critical minerals and high-tech metals, including cobalt.

Global overview

The Democratic Republic of the Congo (DRC) has 55% of the world’s known cobalt reserves and accounted for 74% of world production in 2023.

Australia has 15% of the world’s known cobalt reserves, second only to the DRC, but accounts for only 2% of world cobalt production.

Indonesia accounted for 7% of world cobalt production in 2023, largely as a by-product of nickel mining. Indonesia and Cuba both have 5% of the world’s terrestrial nickel resource, or the third largest share.

China produces around 70% of the world’s refined cobalt, mostly from partially refined cobalt imported from the DRC, with most of this production used by the rechargeable battery industry.

2023 Global cobalt reserves – 11 million tonnes cobalt content

2023 Global cobalt production – 230,000 tonnes cobalt content

Source for global overview content and charts: modified from USGS Mineral Commodity Summaries 2024.

NSW project highlights

NSW has multiple projects in development. The Broken Hill Cobalt Project and Sunrise Battery Materials Project are both well advanced and have downstream potential for Australia. Advanced exploration projects also include NiCo Young, Flemington and the West Lynn nickel–cobalt projects.

| Project (deposit) |

Contained cobalt (t) |

|---|---|

| Broken Hill Cobalt Project (Pyrite Hill, Big Hill & Railway) |

81,100 |

| Burra (Owendale) |

20,500 |

| Flemington (Syerston) |

2,741 |

| Homeville (Collerina) |

10,300 |

| NiCo Young (Ardnaree & Thuddungra) |

45,050 |

| Sunrise Battery Materials Project (Syerston) |

167,000 |

| West Lynn & Summervale |

11,000 |

| Note: The contained cobalt totals are based on combined resources for that project (i.e. the amount of cobalt as a metal that is contained within one or more resources). Source: New South Wales MetIndEx database. | |

Notes:

All percentages (including in the pie charts) are rounded to whole numbers.

Forecasts are based on NSW Resources’ interpretation of available information. Forecasts are inherently uncertain and should be seen as a guide only. Actual outcomes may be different.